IRS Transcript Monitoring Service

Stay Ahead of the IRS—Protect Your Finances Before Notices Arrive

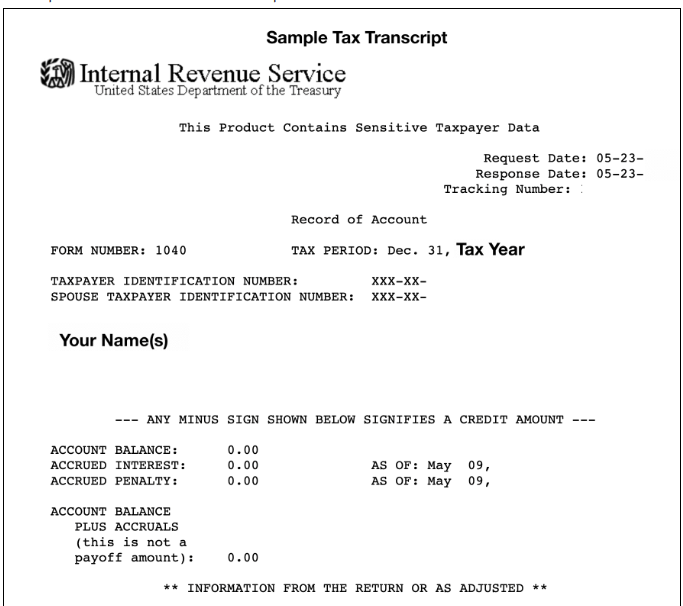

Most taxpayers don’t realize the IRS updates transcripts weeks before official letters are mailed. By the time the notice shows up, penalties and interest may already be adding up.

Our IRS Transcript Monitoring Service keeps you protected year-round. We identify potential issues in real time and give you the opportunity to act before they escalate.

What We Monitor

New penalties and interest

Balance changes or new tax assessments

Amended or posted returns

IRS collection actions (liens, levies, audits)

Installment agreement status (pending, terminated, or defaulted)

Why It Matters

Catch IRS actions weeks, even months, before notices arrive

Resolve issues faster and reduce penalties

Avoid “surprise” IRS notices that disrupt your life or business

Create year-round peace of mind with proactive monitoring

Affordable Protection

Pricing: $375 per year per client

Options:

Family bundles

Monthly subscription plans

Add-on to your tax resolution or bookkeeping services

Think of it as “insurance against IRS surprises.”

Who Benefits

Individuals who want peace of mind knowing IRS issues won’t catch them off guard.

Business owners who need to stay compliant and protect cash flow

Nonprofits who can’t afford disruptions from missed filings or penalties

How It Works

You sign up for monitoring.

We connect securely with the IRS system.

Our team reviews transcripts regularly.

You receive an alert with action steps whenever a change occurs.

It’s simple, secure, and built for your protection.

Bundle With Tax Resolution

Are you already working with us on an IRS issue? Transcript Monitoring is the perfect aftercare service. Once your resolution case is closed, monitoring ensures your account stays clean—and you stay worry-free.

Get Started Today

Don’t wait for the IRS to send you a notice. Protect yourself with proactive monitoring.